Dholera Special Investment Region (SIR), located approximately 100 km southwest of Ahmedabad in Gujarat, India, is poised to become India’s first greenfield smart city and a global manufacturing hub under the Delhi-Mumbai Industrial Corridor (DMIC) project. Spanning 920 square kilometers, it is designed to attract industrial, commercial, and residential investments with world-class infrastructure and connectivity. For investors, the decision to invest in properties inside Dholera SIR or outside its boundaries involves weighing distinct benefits and challenges. This article explores both options, comparing their potential to help investors make informed decisions.

Properties Inside Dholera SIR

Benefits of Investing Inside Dholera SIR

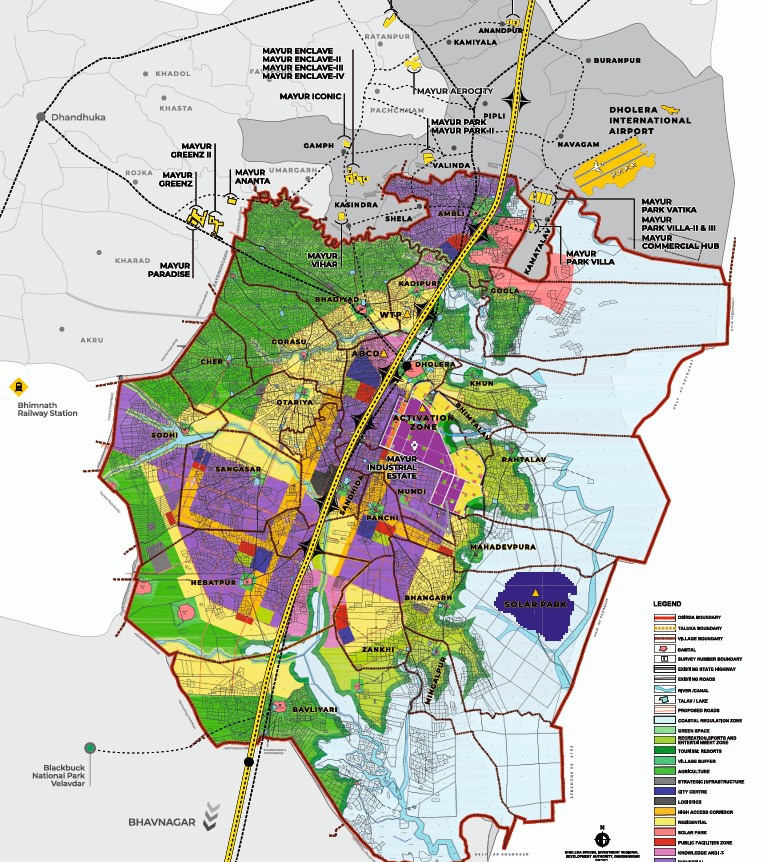

- World-Class Infrastructure: Properties within Dholera SIR benefit from meticulously planned infrastructure, including a 250-meter-wide 10-lane expressway, metro rail, and a dedicated freight corridor (DFC). The region features smart utilities like ICT-enabled traffic management, zero-waste water systems, and a 5,000 MW solar park, ensuring sustainability and efficiency.

- High Appreciation Potential: With development ongoing until 2040, property values inside Dholera SIR are expected to appreciate significantly due to its status as a global manufacturing and trading hub. Early investors can capitalize on currently low land prices, which are undervalued compared to other smart cities.

- Government Support and Incentives: The Dholera SIR project, backed by both central and Gujarat governments, offers investor-friendly policies, including tax breaks, duty exemptions, and fast-track approvals, particularly for industries like semiconductors, automobiles, and defense.

- Strategic Connectivity: Proximity to major cities like Ahmedabad, Bhavnagar, and Vadodara, along with an upcoming international airport and seaport, enhances accessibility for businesses and residents. The metro rail and expressway will connect Dholera to key urban centers, boosting its appeal.

- Diverse Investment Options: The region includes residential plots (minimum 200 m²), commercial spaces, industrial zones, and knowledge/IT hubs, catering to various investor profiles. The “plug-and-play” approach ensures fully developed, ICT-enabled plots, reducing setup costs.

- Job Creation and Rental Income: With major corporations like Tata Electronics and Foxconn-Vedanta investing (e.g., a $18.65 billion semiconductor facility), Dholera is expected to generate significant employment, driving demand for residential and commercial rentals.

Challenges of Investing Inside Dholera SIR

- Long Development Timeline: While 95% of the first phase infrastructure is complete, full-scale development may take until 2040. Investors must be prepared for a long-term commitment, as returns may be delayed.

- High Initial Costs: Properties inside Dholera SIR, especially in prime areas like the Activation Area or Town Planning Schemes (TP 1-6), may command higher prices than outside plots due to planned infrastructure and amenities.

- Regulatory Compliance: Investments require adherence to strict guidelines under the Dholera Special Investment Region Development Authority (DSIRDA), including obtaining NA (non-agricultural) clearance and ensuring clean titles, which can add complexity. thromboembolism

- Environmental Concerns: Urbanization may impact local ecosystems, such as the Gulf of Khambhat’s biodiversity. Authorities must balance development with sustainable practices, which could affect project timelines or costs.

Properties Outside Dholera SIR

Benefits of Investing Outside Dholera SIR

- Lower Initial Costs: Land prices outside Dholera SIR, particularly within 500 meters of its boundaries, are significantly lower than inside, making it an attractive option for budget-conscious investors.

- Proximity to Development: Properties just outside Dholera SIR can still benefit from the region’s growth, as infrastructure like roads and connectivity extends beyond the SIR boundaries. For example, areas near the proposed international airport or expressway offer spillover benefits.

- Flexibility in Development: Outside properties may face fewer regulatory restrictions, allowing investors more freedom in development plans compared to the structured town planning schemes inside Dholera SIR.

- Potential for Future Inclusion: As Dholera expands, areas immediately outside the SIR may be incorporated into future development phases, potentially increasing their value.

Challenges of Investing Outside Dholera SIR

- Limited Infrastructure: Properties outside Dholera SIR lack the world-class amenities and smart utilities available inside, such as ICT-enabled systems, metro connectivity, and sustainable infrastructure, reducing their appeal for high-end buyers or businesses.

- Lower Appreciation Potential: While properties outside may appreciate due to proximity, the growth rate is likely slower compared to inside Dholera SIR, where planned development and major investments drive higher returns.

- Uncertain Connectivity: Access to major infrastructure like the international airport, metro, or DFC may be less direct, potentially limiting business or residential appeal.

- Risk of Speculation: Outside areas may attract speculative investments with less certainty about future development, increasing the risk of lower-than-expected returns.

Comparison for Investors: Which is the Better Option?

Return on Investment (ROI)

- Inside Dholera SIR: Offers higher ROI potential due to planned infrastructure, government backing, and major corporate investments (e.g., Foxconn-Vedanta’s $18.65 billion semiconductor plant). Forbes lists Dholera among the top 12 fastest-growing cities globally, signaling strong appreciation.

- Outside Dholera SIR: Lower initial costs provide an affordable entry point, but appreciation is slower and less certain, relying on spillover effects from Dholera’s growth.

Winner: Inside Dholera SIR for long-term, high-return investors.

Risk Profile

- Inside Dholera SIR: Lower risk due to government support, clear titles (NA, NOC), and established development plans. However, long timelines and regulatory compliance add some uncertainty.

- Outside Dholera SIR: Higher risk due to speculative nature and lack of guaranteed infrastructure. Investors must carefully verify land titles and proximity to Dholera’s boundaries (ideally within 500 meters).

Winner: Inside Dholera SIR for risk-averse investors.

Accessibility and Connectivity

- Inside Dholera SIR: Superior connectivity with a 10-lane expressway, metro rail, and an international airport within 1 km. Proximity to the DMIC and ports enhances business potential.

- Outside Dholera SIR: Benefits from proximity to Dholera’s infrastructure but lacks direct access to smart utilities or plug-and-play systems, potentially limiting appeal.

Winner: Inside Dholera SIR for seamless connectivity.

Affordability

- Inside Dholera SIR: Higher upfront costs due to premium infrastructure and planned development, especially in areas like the Activation Area or TP 1-6.

- Outside Dholera SIR: More affordable, appealing to investors with limited budgets or those seeking short-term gains through speculative investments.

Winner: Outside Dholera SIR for budget-conscious investors.

Sustainability and Lifestyle

- Inside Dholera SIR: Emphasizes sustainability with green spaces, a 5,000 MW solar park, and zero-waste systems. The “live-work-play” model ensures a high quality of life with modern amenities.

- Outside Dholera SIR: Limited access to green infrastructure or smart city features, potentially offering a less modern lifestyle.

Winner: Inside Dholera SIR for eco-conscious and lifestyle-focused investors.

Recommendations for Investors

- Long-Term Investors: Investing inside Dholera SIR, particularly in the Activation Area or Town Planning Schemes (TP 1-6), is ideal due to high appreciation potential, government support, and world-class infrastructure. Focus on residential plots, commercial spaces, or industrial zones in high-demand areas like TP2A or near the international airport.

- Budget-Conscious Investors: Properties outside Dholera SIR, within 500 meters of its boundaries, offer a cost-effective entry point. Prioritize areas near the expressway or proposed airport for spillover benefits, but ensure clear titles and NA approval.

- Risk-Averse Investors: Opt for inside Dholera SIR with reputable developers like Samyak Buildcon or Shivgan Infratech, ensuring NA, NOC, and RERA-compliant projects to minimize legal risks.

- Short-Term Speculators: Outside properties may suit those seeking quick gains, but thorough due diligence on land documents and proximity to Dholera’s infrastructure is critical to avoid speculative pitfalls.

Conclusion

Investing in Dholera SIR presents a unique opportunity to be part of India’s first greenfield smart city, with significant economic potential driven by the DMIC and major corporate investments. Properties inside Dholera SIR offer superior infrastructure, connectivity, and long-term returns, making them the preferred choice for investors seeking high growth and stability. However, outside properties provide a more affordable entry point for those willing to accept lower returns and higher risks. Investors should align their choice with their financial goals, risk tolerance, and investment horizon, while ensuring due diligence on land titles and proximity to Dholera’s infrastructure. For the latest updates on Dholera SIR projects, visit dholera.gujarat.gov.in.